how to apply for helb compliance certificate online via ecitizen – step by step guide

This article is about how to apply for HELB compliance certificate online via Ecitizen. It is a step by step guide that simplifies the process. This is one of the many government services offered through Ecitizen. Let’s get into it.

1. Visit the eCitizen Website

Start by accessing the eCitizen website (www.ecitizen.go.ke) using your computer or a mobile device with an internet connection.

ECitizen is a platform that offers access to various government services, making it convenient to apply for and manage documents and services.

2. Create or Log in to Your eCitizen Account

If you already have an eCitizen account, you can log in using your existing credentials. If you’re new to eCitizen, you’ll need to create an account. This typically involves providing your personal details, creating a username, and setting up a secure password.

Make sure to remember your login information, as you’ll need it to access the eCitizen platform.

Once you’re logged into your eCitizen account, you’ll be presented with a list of available government services.

Look for the “Higher Education Loans Board (HELB)” service and click on it.

This will grant you access to the HELB portal within eCitizen.

4. Select the “Apply for Compliance Certificate” Service

Within the HELB portal on eCitizen, look for the specific service related to applying for a Compliance Certificate. Select this service to initiate the application process.

5. Provide Required Information

Fill out the application form with the necessary information.

This will typically include details related to your HELB loan, such as the loan account number and amount, your personal information (name, ID number, contact information), and any other specifics that HELB requires for the application.

6. Upload Supporting Documents

As part of your application, you may be asked to upload supporting documents.

Commonly, this includes proof of loan repayment, such as bank statements or HELB statements.

Ensure that your uploaded documents meet the specified requirements, and follow any size or format guidelines provided by eCitizen.

7. Pay the Processing Fee

Expect to pay a processing fee for your HELB Compliance Certificate application. eCitizen offers various payment methods, which may include mobile money options like M-Pesa and credit/debit card payments.

Follow the payment instructions provided to complete the transaction successfully.

8. Review and Submit

Before finalizing your application, it’s crucial to carefully review all the information you’ve provided on the form.

Make sure that all details are accurate and complete. This step helps prevent delays in processing due to errors or omissions.

Once you’re satisfied with the information, submit your application through the eCitizen portal.

9. Wait for Processing

After submitting your application, it goes through a processing stage conducted by HELB.

The processing time can vary depending on factors like the volume of applications and administrative procedures. Be prepared to exercise patience during this waiting period.

10. Download Your HELB Compliance Certificate

Once your application is successfully approved and processed, you’ll receive notification through the eCitizen platform that your HELB Compliance Certificate is ready for download.

Log in to your eCitizen account, access the HELB service, and retrieve the certificate. Be sure to save it for your records.

10 reasons why you need helb compliance certificate

- Employability: Many employers require job applicants to provide a HELB Compliance Certificate as part of their background checks. It serves as evidence that an individual has honored their student loan repayment obligations, enhancing their employability.

- Government Jobs: To qualify for certain government positions and opportunities, applicants often need to demonstrate financial responsibility by presenting a HELB Compliance Certificate.

- Business and Professional Licensing: Some business licenses and professional association memberships may require proof of cleared HELB loans. Without a Compliance Certificate, individuals may face challenges in establishing or maintaining their businesses or professional careers.

- Financial Transactions: Financial institutions and banks may request a HELB Compliance Certificate when individuals apply for loans, mortgages, or credit facilities. It helps in assessing an individual’s financial responsibility and creditworthiness.

- Credit Score and Credibility: A good history of student loan repayment, as indicated by a Compliance Certificate, can positively impact an individual’s credit score and overall financial credibility. This can result in better access to credit and financial services.

- Government Tenders and Contracts: In business, many government tenders and contracts require potential contractors to provide a HELB Compliance Certificate. This is to ensure that they are financially responsible and compliant with their loan obligations.

- Postgraduate Studies: Some postgraduate programs, including master’s and doctoral degrees, may require applicants to provide evidence of cleared HELB loans. A Compliance Certificate can be a prerequisite for academic advancement.

- Personal Financial Responsibility: Beyond its practical applications, the Compliance Certificate promotes personal financial responsibility. It encourages individuals to fulfill their financial commitments and supports the sustainability of the HELB loan program.

- Legal Obligation: Fulfilling HELB loan repayment obligations, as indicated by a Compliance Certificate, is a legal requirement. Failure to meet these obligations may result in penalties, legal actions, or difficulties in securing credit or employment.

- Supporting Education for Others: By repaying their loans and obtaining a Compliance Certificate, individuals contribute to the availability of loans for future students. The HELB program depends on repayments to continue providing financial support for higher education.

faqs about helb compliance certificate

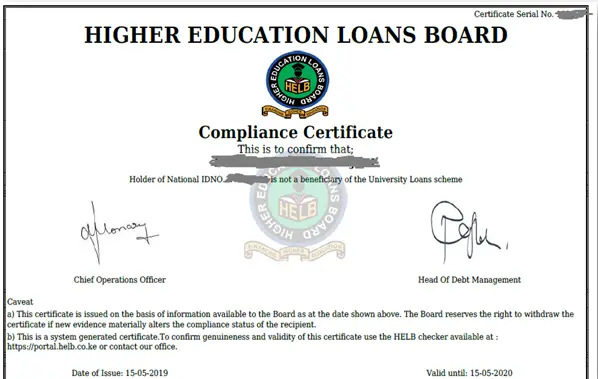

1. What is a HELB Compliance Certificate?

Answer: A HELB Compliance Certificate is an official document issued by the Higher Education Loans Board (HELB) in Kenya. It certifies that the holder has successfully repaid their education loan, demonstrating financial responsibility and compliance with loan repayment obligations.

2. Why do I need a HELB Compliance Certificate?

Answer: A HELB Compliance Certificate is often required for various purposes, including job applications, government positions, business licensing, professional associations, and financial transactions. It serves as evidence of responsible loan repayment.

3. How do I apply for a HELB Compliance Certificate?

Answer: You can apply for a HELB Compliance Certificate through the HELB website. The process typically involves creating an account, filling out an application form, submitting required documents, paying a processing fee, and waiting for approval.

4. Can I get a HELB Compliance Certificate if I have an outstanding loan balance?

Answer: No, you cannot obtain a HELB Compliance Certificate if you have an outstanding loan balance. This certificate is only issued to individuals who have fully cleared their education loans with HELB.

5. What documents are required for a HELB Compliance Certificate application?

Answer: The specific documents required may vary, but you typically need to provide proof of loan repayment, such as bank statements or HELB statements, and a copy of your national identification card (ID) or passport.

6. Is there a fee for applying for a HELB Compliance Certificate?

Answer: Yes, there is usually a processing fee associated with the application for a HELB Compliance Certificate. The fee covers administrative costs. The amount may vary, so it’s important to check the latest fee information on the HELB website.

7. How long does it take to receive a HELB Compliance Certificate?

Answer: The processing time for a HELB Compliance Certificate application can vary. It depends on factors such as the volume of applications and administrative processes. Applicants should be prepared for some waiting time.

8. Can I request a replacement if I lose my HELB Compliance Certificate?

Answer: Yes, you can request a replacement if you lose your HELB Compliance Certificate. You should contact HELB for guidance on the replacement process.

9. What happens if I do not repay my HELB loan?

Answer: Failure to repay your HELB loan can lead to penalties, legal actions, and difficulties in securing credit, employment, or business opportunities. It is a legal obligation to repay HELB loans.

10. Can I apply for a HELB Compliance Certificate if I did not receive a loan from HELB?

Answer: A HELB Compliance Certificate is typically issued to individuals who have received and successfully repaid HELB loans. If you did not receive a loan from HELB, you would not need this certificate.

How to apply for HELB compliance certificate through HELB portal

How to apply for Certificate of Good Conduct

How to apply for Taxpayer Registration Certificate