Ushuru Sacco Membership Eligibility and Requirements

This article is about Ushuru Sacco Membership Eligibility and Requirements. The Customs Sacco was established in 1970 by the employees of the Customs & Excise Department of the Ministry of Finance, under the name Customs & Excise Workers (CUEW) Sacco. When the Kenya Revenue Authority (KRA) was established in 1995, CUEW Sacco changed its name in 2002 to Ushuru Sacco, to reflect the new drive for integration of KRA with other public sector organizations in privacy.

With an asset base of 6.12 billion, Ushuru Sacco is one of the largest Depository Saccos in Kenya.

Ushuru Sacco Membership Eligibility and Requirements

Eligibility for Ushuru Sacco Members

- Ushuru Sacco is a member and member business open to all resident and non-resident Kenyans anywhere in the world.

- A person can become a member if they meet the following qualifications:

- Not under 18 years.

- Is a citizen living in Kenya.

-

Has not been convicted of crimes involving fraud and dishonesty. - Not a member of a similar savings and loan association during the term of employment.

- Within the scope of the working group of KRA, government ministry, any company or any recognized organization or spouse of an existing member.

- It is not directly or indirectly the lender or doing such activities that are against the objectives of the sacco.

He has a good personality.

Requirements to be a member of Ushuru Sacco

A completed membership application form which can be downloaded from the Sacco website or collected from any Sacco branch.

- A national identity card.

- Passport size photo.

- An income of Kshs 1,000.

- Share Capital Kshs 30,000.

- Monthly savings of Kshs 3,000.

- Additional registration fee is Kshs 3,000.

- Monthly RMF (Kshs 300).

Benefits of membership

- Loan term of 48 hours or less.

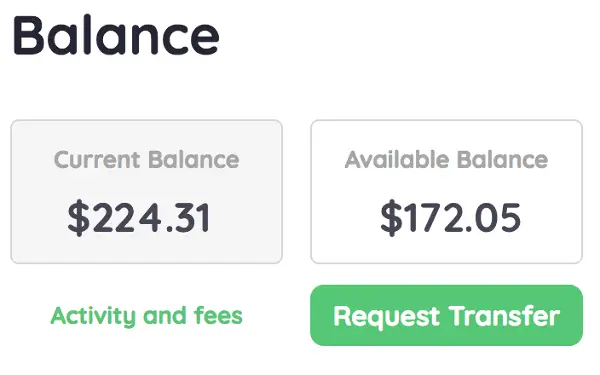

- Access to other channels 24 hours a day; mobile banking, online portal, sacco link debit card and many more.

- Get a quick and convenient mobile loan up to Kshs 150,000.

Ushuru Sacco contact

Head Office: Ushuru Sacco Centre, Wood Avenue, Kilimani, Nairobi.

Contact: 020 760 8700.