how to apply for Taxpayer Registration Certificate online via itax – complete guide

This article is about how to apply for Taxpayer Registration Certificate online via itax in Kenya.

what is a taxpayer registration certificate?

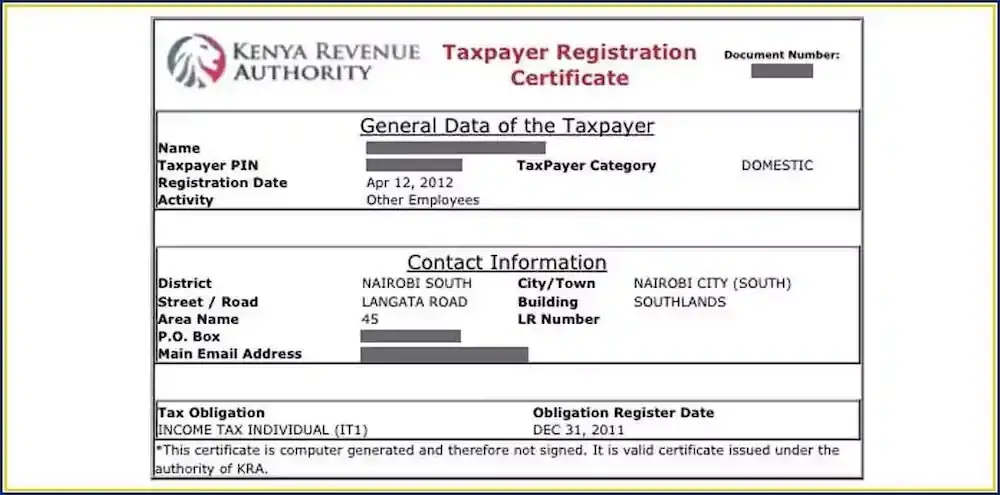

In Kenya, “TRC” stands for “Taxpayer Registration Certificate.” It’s an official document issued by the Kenya Revenue Authority (KRA) to individuals and businesses, serving as proof of tax registration. The TRC contains a unique Taxpayer Identification Number (TIN) and is necessary for tax compliance and various financial and business transactions in Kenya.

how to apply for Taxpayer Registration Certificate in kenya

1. Access the KRA iTax Portal

To begin the process, access the official Kenya Revenue Authority (KRA) iTax portal by visiting the KRA website (www.kra.go.ke). It’s essential to have a stable internet connection and use a computer or mobile device that allows you to access the internet.

2. Registration and Login

If you’re a first-time user of the iTax portal, you’ll need to click on the “Register” button. This will take you to the registration page where you’ll need to provide your personal details.

You’ll be required to create a username and password to secure your account.

If you already have an existing iTax account, you can simply log in using your username and password.

3. Access the e-Registration Section

Upon successful login, navigate to the “e-Registration” tab or section within the iTax portal.

This is where you can initiate various registration processes, including the application for your Taxpayer Registration Certificate.

4. Choose the Tax Type

Under the “e-Registration” section, you’ll typically find various tax types to choose from.

For most businesses, you’ll want to select the relevant option, such as “Income Tax – Company” or “Income Tax – Partnership,” depending on your business structure.

5. Select Taxpayer Type

Next, select the appropriate taxpayer type based on your business structure.

Common options include “Resident Individual” for sole proprietors or “Non-Individual” for registered companies.

6. Fill in the Application Form

Complete the online Taxpayer Registration Certificate application form with accurate and up-to-date information. You’ll be asked to provide details about your business, which may include your business name, business location, and your KRA PIN. Ensure that you fill in all the required fields accurately.

7. Review Your Information

Before proceeding to submission, take a moment to review all the information you’ve entered on the application form. Ensure that all details are accurate and complete, as any errors or discrepancies could potentially delay the processing of your application.

8. Submit the Application

Once you are satisfied with the information you’ve provided and have reviewed it for accuracy, submit the application electronically through the iTax portal. The system will generate an acknowledgement receipt as proof of your submission.

9. Payment of Processing Fee

In many cases, to process your TRC application, you will be required to pay a processing fee. The fee amount can vary, so verify the current fee on the KRA website.

Payment can be made through the iTax portal using various payment options, which may include mobile money, bank transfers, or credit/debit cards.

10. Wait for Processing

After successfully submitting your application and making the necessary payment, you’ll need to wait for the KRA to process your request.

The processing time can vary depending on the volume of applications and other factors. You can periodically check your iTax account for updates on the status of your application.

11. Receive Your Taxpayer Registration Certificate

Once your application is approved and processed, you will receive your Taxpayer Registration Certificate online. This certificate will contain your unique Taxpayer Identification Number (TIN), which is essential for all tax-related activities and compliance in Kenya.

12. Maintain Compliance

After obtaining your Taxpayer Registration Certificate, it’s crucial to maintain it by fulfilling all tax obligations, including filing your tax returns, as required by the KRA.

Failure to do so may result in penalties and potential issues with your TRC status.

importance of taxpayer registration certificate

Tax Compliance:

The TRC is a clear indicator of tax compliance. It serves as evidence that the holder is registered as a taxpayer with the Kenya Revenue Authority (KRA) and is fulfilling their tax obligations as required by law.

Legitimacy and Recognition:

Holding a TRC provides official recognition by the KRA, verifying that the individual or business is a recognized and registered taxpayer. It enhances their legitimacy in financial matters and transactions.

Business Transactions:

The TRC is often a mandatory requirement for various business transactions, such as government contracts, procurement, and participation in tenders. Without a valid TRC, businesses may be ineligible for these opportunities, limiting their business activities.

Employment:

Many employers consider a valid TRC as an essential criterion for hiring. It signifies that the job applicant is tax-compliant and financially responsible, which can enhance their employability and trustworthiness.

Access to Financial Services:

Banks and financial institutions frequently request a TRC when individuals or businesses apply for loans, credit facilities, or other financial services. This document helps mitigate financial risk and adds to the credibility of the applicant.

Government Services:

When individuals or businesses seek government services, permits, approvals, or licenses, the TRC may be a prerequisite. It ensures that those receiving government services are responsible taxpayers, contributing to government revenue.

Regulatory Compliance:

Regulatory bodies, professional associations, and industry regulators may mandate that their members hold a TRC. This requirement ensures that regulated entities meet their tax obligations, promoting transparency and financial responsibility.

Tax Filing and Reporting:

The TRC plays a crucial role in the process of filing tax returns and accurately reporting income. It aids the KRA in tracking and collecting taxes efficiently.

Taxpayer Identification:

The TRC contains a unique Taxpayer Identification Number (TIN), a fundamental identifier for all tax-related activities and transactions in Kenya. It simplifies and streamlines tax processes.

Transparency and Accountability:

Holding a valid TRC promotes transparency and accountability in financial and business transactions. It signifies that individuals and businesses are contributing to government revenue and complying with tax regulations, supporting good governance.

faqs about taxpayer registration certificate in kenya

1. What is a Taxpayer Registration Certificate (TRC)?

Answer: A Taxpayer Registration Certificate (TRC) is an official document issued by the Kenya Revenue Authority (KRA) to individuals and businesses, confirming their registration as taxpayers and their compliance with tax regulations in Kenya.

2. Who needs a TRC in Kenya?

Answer: Anyone who is required to pay taxes in Kenya, whether an individual or a business entity, may need to obtain a TRC. It is a crucial document for tax compliance and participation in various financial and business activities.

3. How can I apply for a TRC in Kenya?

Answer: You can apply for a TRC through the KRA’s iTax portal. You’ll need to complete the application form, provide the necessary information, and follow the application process outlined on the portal.

4. What information is required when applying for a TRC?

Answer: When applying for a TRC, you may be required to provide personal or business information, including your name, business details, business structure, nature of business, contact information, and your KRA PIN.

5. Is there a fee for applying for a TRC?

Answer: As of my last knowledge update in January 2022, there was no specific fee for applying for a TRC. However, you may need to pay processing fees or other related fees during the application process. Be sure to check the latest fee information on the KRA website.

6. How long is a TRC valid?

Answer: A Taxpayer Registration Certificate is typically valid for an indefinite period, but it may need to be renewed if there are significant changes in your taxpayer status or if the KRA requires it.

7. Can I check the status of my TRC application online?

Answer: Yes, you can check the status of your TRC application through the KRA’s iTax portal. The portal provides updates on the status of your application, including whether it has been approved and when you can expect to receive your TRC.

8. What happens if I lose my TRC?

Answer: If you lose your TRC, you can apply for a replacement by contacting the KRA and following the necessary procedures. It’s important to report a lost TRC to prevent any potential misuse.

9. Can a TRC be used as a form of identification in Kenya?

Answer: A TRC is primarily a document related to tax registration and compliance. It is not a general form of identification like a national ID card or passport. While it may be requested for specific transactions, it is not a widely accepted form of personal identification.

10. What are the consequences of not having a valid TRC in Kenya?

Answer: Not having a valid TRC may limit your eligibility for various business opportunities, government contracts, job applications, and financial services. It can also result in penalties or legal consequences if you do not meet your tax obligations.

How to apply KRA Tax Compliance Certificate